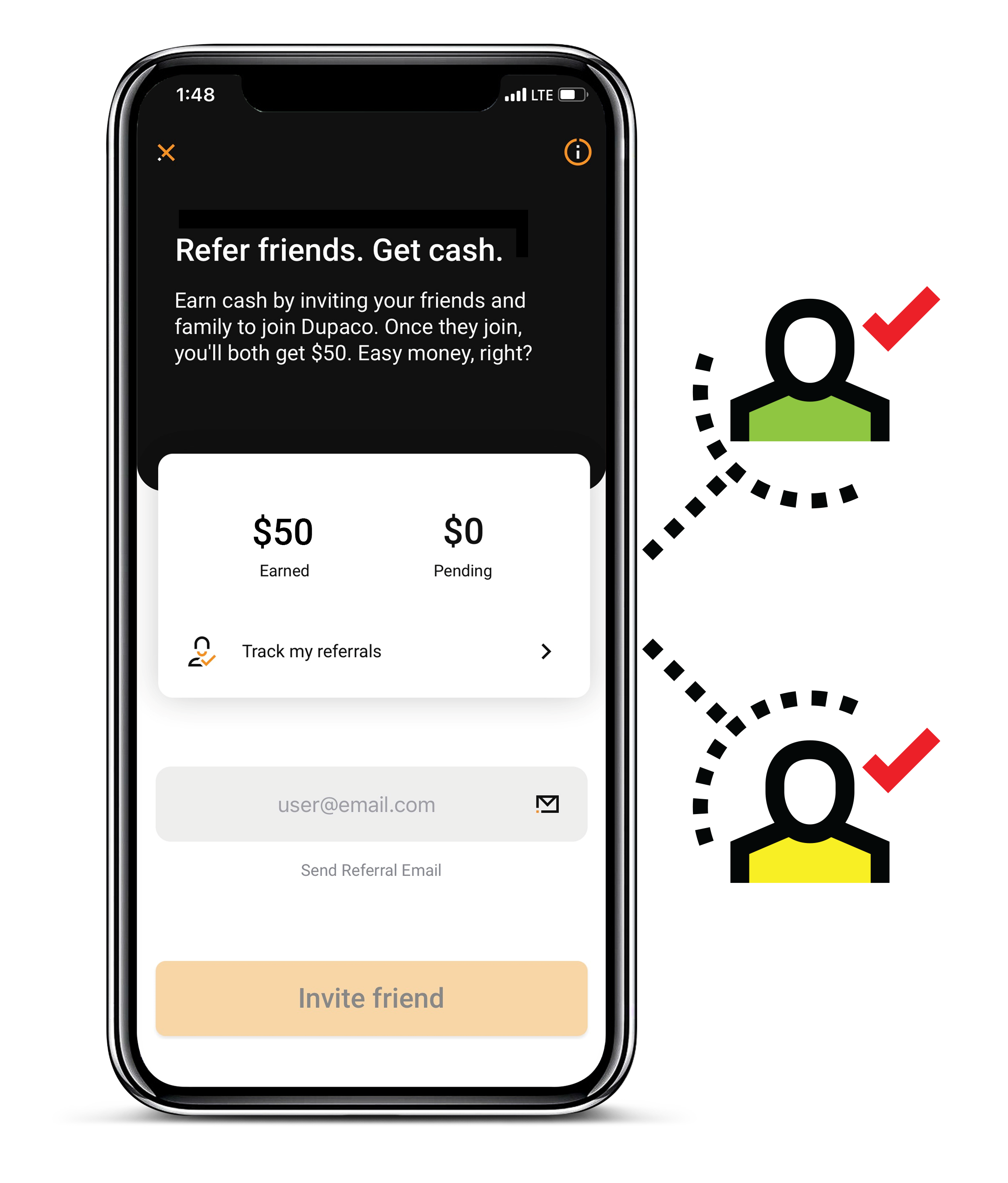

Refer friends. Get cash.

Love Dupaco? Let your friends and family know!

Participate in Dupaco’s Refer-a-Friend and you could earn $50 for every person you refer to Dupaco1. And to sweeten the deal even more, we’ll give each of your referrals the chance to earn $502, too! To get started, log in to your Shine account and visit your Refer-a-friend dashboard under ‘My Perks’.

To be an eligible referrer, you must...

- Be a personal member with a primary savings account with $25 minimum balance

- Have an active Dupaco checking account4 at time of referral and referral payout

- Not have had a loan delinquent by 60 or more days OR a negative checking account balance for 30 or more days at time of referral payout

- Refer members through Shine Online or Mobile Banking

Free Checking

| Balance | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|

| N/A | N/A | N/A | None | N/A |

| 1Checking Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. | ||||

1st Rate Checking

| Balance | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|

| $100,000+ | 0.10% | 0.10% | None | $100,000 |

| $25,000 - $99,999.99 | 0.10% | 0.10% | None | $25,000 |

| $5,000 - $24,999.99 | 2.96% | 3.00% | None | $5,000 |

| Less than $5,000 | N/A | N/A | None | N/A |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1APY= Annual Percentage Yield. Rates are variable and may change after opening the account. APY is accurate as of the last dividend declaration date. Fees could reduce account earnings. |

||||

Savings Accounts

| Account Type | Balance Tier | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|---|

| Share Savings | $25,000+ | 0.25% | 0.25% | $25 | $25,000 |

| Share Savings | $10,000 - $24,999.99 | 0.20% | 0.20% | $25 | $10,000 |

| Share Savings | $2,500 - $9,999.99 | 0.15% | 0.15% | $25 | $2,500 |

| Share Savings | $100 - $2,499.99 | 0.10% | 0.10% | $25 | $100 |

| Share Savings | less than $100 | n/a | n/a | $25 | n/a |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1Savings Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. |

|||||

You Name It Savings

| Account Type | Balance Tier | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|---|

| You Name It Savings | $25,000+ | 0.25% | 0.25% | $25 | $25,000 |

| You Name It Savings | $10,000 - $24,999.99 | 0.20% | 0.20% | $25 | $10,000 |

| You Name It Savings | $2,500 - $9,999.99 | 0.15% | 0.15% | $25 | $2,500 |

| You Name It Savings | $100 - $2,499.99 | 0.10% | 0.10% | $25 | $100 |

| You Name It Savings | less than $100 | n/a | n/a | $25 | n/a |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1Savings Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. |

|||||

Holiday Club Savings

| Account Type | Balance Tier | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|---|

| Holiday Club Savings | n/a | 0.25% | 0.25% | $25 | $100 |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1Savings Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. |

|||||

Launchpad Savings Account

| Account Type | Dividend Rate | Annual Percentage Yield (APY)1 | Min. Balance | Max. Balance |

|---|---|---|---|---|

| Launchpad Savings | 3.70% | 3.75% | $5 | $1,000 |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1Launchpad Savings Rate: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. Limitations: If there is no deposit to this account in any 90-day period, account will be closed and the funds will be deposited, less the $5, into member's share savings. Once the balance reaches $1,000 you have 90 days to move the funds into a Dupaco Financial Services IRA. If the funds are not moved into one of these accounts within 90 days of reaching the $1,000 balance, the account will be closed and the funds will be deposited, less the $5 fee, into member's share savings. A $5 penalty applies for each withdrawal from this account. The penalty is waived if the funds are transferred to an IRA. This is not a retirement account and there are no tax benefits on this account. |

||||

Investor’s Choice

| Balance Tier | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|

| $100,000+ | 0.50% | 0.50% | $2,500 | $100,000 |

| $25,000 - $99,999.99 | 0.40% | 0.40% | $2,500 | $25,000 |

| $10,000 - $24,999.99 | 0.35% | 0.35% | $2,500 | $10,000 |

| $2,500 - $9,999.99 | 0.30% | 0.30% | $2,500 | $2,500 |

| up to $2,499.99 | 0.25% | 0.25% | $2,500 | $0.01 |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1Money Market Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. Available to individual and small business member accounts only. Not available to investment companies and financial institutions. Maximum deposit limits may apply. |

||||

High-Yield Savings

| Balance Tier | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|

| $1,000,000+ | 2.42% | 2.45% | $50,000 | $1,000,000+ |

| $500,000 - $999,999.99 | 2.23% | 2.25% | $50,000 | $500,000 |

| $250,000 - $499,999.99 | 2.03% | 2.05% | $50,000 | $250,000 |

| $100,000 - $249,999.99 | 1.83% | 1.85% | $50,000 | $100,000 |

| up to $99,999.99 | 1.49% | 1.50% | $50,000 | $0.01 |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1High-Yield Savings: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. $50,000 minimum balance to open and maintain the account. Rates may vary after account is opened. Minimum daily balance to earn must be maintained each day to obtain the disclosed APY. Dividends are calculated daily and credited and compounded monthly. Programs, rates, terms, and conditions are subject to change without notice. Fees may reduce earnings on account. Available to individuals, trusts, estates and small businesses. Not available to investment companies and financial institutions. Maximum deposits limits may apply. |

||||

Special

| Term | Dividend Rate | Annual Percentage Yield (APY) | Min. to Earn |

|---|---|---|---|

| 7 Month Fixed Jumbo Certificate Special | 4.05% | 4.10%1 | $100,000 |

| 7 Month Fixed Certificate Special | 3.96% | 4.00%2 | $1,000 |

| 25 Month Fixed Jumbo Certificate Special | 3.86% | 3.90%1 | $100,000 |

| 25 Month Fixed Certificate Special | 3.76% | 3.80%2 | $1,000 |

| Rates are effective as of 11/14/2025 and are subject to change without notice. 1Fixed Jumbo Term Certificate Special Rate: Minimum amount required to open any Special Jumbo Term Share Certificate is $100,000. The dividend rate and annual percentage yield (APY) may change. Dividends begin to accrue on the business day you deposit non-cash items (for example, checks). Dividends will be compounded semi-annually and will be credited to the account semi-annually. Dividends on your account will be credited by adding the dividends to the principle. The annual percentage yield assumes dividends will remain on deposit until maturity. Fees could reduce earnings on the account. A penalty will be imposed for early withdrawal. 2Fixed Certificate Special Rate: Minimum amount required to open any Special Term Share Certificate is $1,000. The dividend rate and annual percentage yield (APY) may change. Dividends begin to accrue on the business day you deposit non-cash items (for example, checks). Dividends will be compounded semi-annually and will be credited to the account semi-annually. Dividends on your account will be credited by adding the dividends to the principle. The annual percentage yield assumes dividends will remain on deposit until maturity. Fees could reduce earnings on the account. A penalty will be imposed for early withdrawal. |

|||

Regular

| Term | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Earn |

|---|---|---|---|

| 60 Month | 1.99% | 2.00% | $1,000 |

| 48 Month | 2.09% | 2.10% | $1,000 |

| 36 Month | 2.29% | 2.30% | $1,000 |

| 30 Month | 2.48% | 2.50% | $1,000 |

| 24 Month | 2.68% | 2.70% | $1,000 |

| 18 Month | 2.88% | 2.90% | $1,000 |

| 12 Month | 3.08% | 3.10% | $1,000 |

| 6 Month | 3.57% | 3.60% | $1,000 |

| Rates are effective as of 11/14/2025 and are subject to change without notice. 1Term Share Certificate Rates: Minimum amount required to open any Term Share Certificate is $1,000. Fees could reduce earnings on the account. A penalty will be imposed for early withdrawal. |

|||

Special IRAs

| Term | Dividend Rate | Annual Percentage Yield (APY) | Min. to Earn |

|---|---|---|---|

| Roth: 7 Month Fixed Jumbo Special | 4.05% | 4.10%1 | $100,000 |

| Traditional: 7 Month Fixed Jumbo Special | 4.05% | 4.10%1 | $100,000 |

| Roth: 7 Month Fixed Special | 3.96% | 4.00%2 | $1,000 |

| Traditional: 7 Month Fixed Special | 3.96% | 4.00%2 | $1,000 |

| Roth: 25 Month Fixed Jumbo Special | 3.86% | 3.90%1 | $100,000 |

| Traditional: 25 Month Fixed Jumbo Special | 3.86% | 3.90%1 | $100,000 |

| Roth: 25 Month Fixed Special | 3.76% | 3.80%2 | $1,000 |

| Traditional: 25 Month Fixed Special | 3.76% | 3.80%2 | $1,000 |

| Rates are effective as of 11/14/2025 and are subject to change without notice. 1Fixed Jumbo Special Rate: Minimum amount required to open any Fixed IRA Jumbo Special certificate is $100,000. The dividend rate and annual percentage yield (APY) may change. Dividends begin to accrue on the business day you deposit non-cash items (for example, checks). Dividends will be compounded semi-annually and will be credited to the account semi-annually. Dividends on your account will be credited by adding the dividends to the principle. The annual percentage yield assumes dividends will remain on deposit until maturity. A penalty will be imposed for early withdrawal. Fees may reduce earnings. 2Fixed Special Rate: Minimum amount required to open any Fixed IRA special certificate is $1,000. The dividend rate and annual percentage yield (APY) may change. Dividends begin to accrue on the business day you deposit non-cash items (for example, checks). Dividends will be compounded semi-annually and will be credited to the account semi-annually. Dividends on your account will be credited by adding the dividends to the principle. The annual percentage yield assumes dividends will remain on deposit until maturity. A penalty will be imposed for early withdrawal. Fees may reduce earnings1 |

|||

Regular IRAs

| Term | Dividend Rate | Annual Percentage Yield (APY) | Min. to Earn |

|---|---|---|---|

| Traditional: 60 Months | 1.99% | 2.00%3 | $1,000 |

| Roth: 60 Months | 1.99% | 2.00%3 | $1,000 |

| Traditional: 36 Months | 2.29% | 2.30%3 | $1,000 |

| Roth: 36 Months | 2.29% | 2.30%3 | $1,000 |

| Traditional: 18 Months | 2.88% | 2.90%3 | $1,000 |

| Roth: 18 Months | 2.88% | 2.90%3 | $1,000 |

| Rates are effective as of 11/14/2025 and are subject to change without notice. 3Fixed IRA Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. A penalty may be incurred for early withdrawals. Fees may reduce earnings. |

|||

Variable IRAs

| Balance | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Earn |

|---|---|---|---|

| Traditional: $15,000+ | 0.60% | 0.60% | $15,000 |

| Roth: $15,000+ | 0.60% | 0.60% | $15,000 |

| Traditional: $5,000-$14,999.99 | 0.50% | 0.50% | $5,000 |

| Roth: $5,000-$14,999.99 | 0.50% | 0.50% | $5,000 |

| Traditional: $0.01-$4,999.99 | 0.45% | 0.45% | $1,000 |

| Roth: $0.01-$4,999.99 | 0.45% | 0.45% | $1,000 |

| Rates are effective as of 07/01/2025 and are subject to change without notice. 1Variable IRA Rates: Dividends and annual percentage yields accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. A penalty will be imposed for early withdrawal. |

|||

Health Savings Account

| Balance | Dividend Rate | Annual Percentage Yield (APY)1 | Min. to Open | Min. to Earn |

|---|---|---|---|---|

| $25,000+ | 0.40% | 0.40% | $25 | $25,000 |

| $10,000 - $24,999.99 | 0.35% | 0.35% | $25 | $10,000 |

| $2,500 - $9,999.99 | 0.30% | 0.30% | $25 | $2,500 |

| up to $2,499.99 | 0.25% | 0.25% | $25 | $0.01 |

| Rates are effective as of 04/01/2023 and are subject to change without notice. 1Health Savings Account Rates: Dividends and annual percentage yields (APY) accurate as of the last dividend declaration date. The dividend rate and annual percentage yield may change after account opening. Fees could reduce earnings on the account. |

||||

1 Referral payments limited to ten (10) per referring member, per calendar year. Referrals are tracked on an individual basis. Bonus paid within 3-5 business days of referred member meeting active checking definition (see below). Referred member must meet active checking definition within 90 days of becoming a member.

2 $50 will be deposited to the referred member’s Dupaco savings account within 3-5 business days after active checking definition met (see below). Account opening subject to qualification and approval. Existing checking accounts excluded. This offer is limited to a maximum of one Dupaco checking account per referred member, regardless of how many accounts a referred member has, and cannot be combined with other checking account offers. Checking account balance of $0 or more required at the time of cash payout. Dupaco membership required. Referred member can join if they live or work within our charter area or meet one of our other field of membership requirements. Please contact the credit union to see other ways you may qualify for a Dupaco membership. Initial savings deposit of $25 required. Other offer restrictions may apply. Please click the individual account sections above for the most up-to-date deposit rates.

3 In order to receive payment for each referral, each person you refer must click on the unique referral link you share with them through Shine Online Banking, use our online application to open a new Dupaco membership and checking account and meet Dupaco’s active checking definition (see below). You must be a personal member with a primary savings account with $25 minimum balance and have an active Dupaco checking account, as defined below, at time of referral and referral payout. You must not have had a loan delinquent by 60 or more days OR a negative checking account balance for 30 or more days at time of referral payout. Referrals must be made through Shine Online or Mobile Banking. Checking account balance of $0 or more required at the time of cash payout.

4 ACTIVE CHECKING DEFINITION: a) Set up direct deposit to your checking account, and have a total of five or more check, debit card or automated clearing house (ACH) debit transactions on that checking account within 90 consecutive days OR b) If you cannot directly deposit to your checking account, then have ten check transactions, or eight debit card transactions, or five ACH debit transactions or three bill pay transactions on that checking account within 90 consecutive days. The referred member must meet one of the criteria during 90 days prior to the referral payout date. Please click the individual account sections above for the most up-to-date deposit rates.