You’re so close: How much do you need to retire?

As retirement gets closer, it’s natural to have some big questions on your mind. And many may come back to a common concern: Will I have enough money?

Whether you’re wondering how much you need to retire, if your savings will last or what kind of income you can expect, now’s the perfect time to make sure everything’s in place. After all, you’ve worked hard to build your nest egg for this moment.

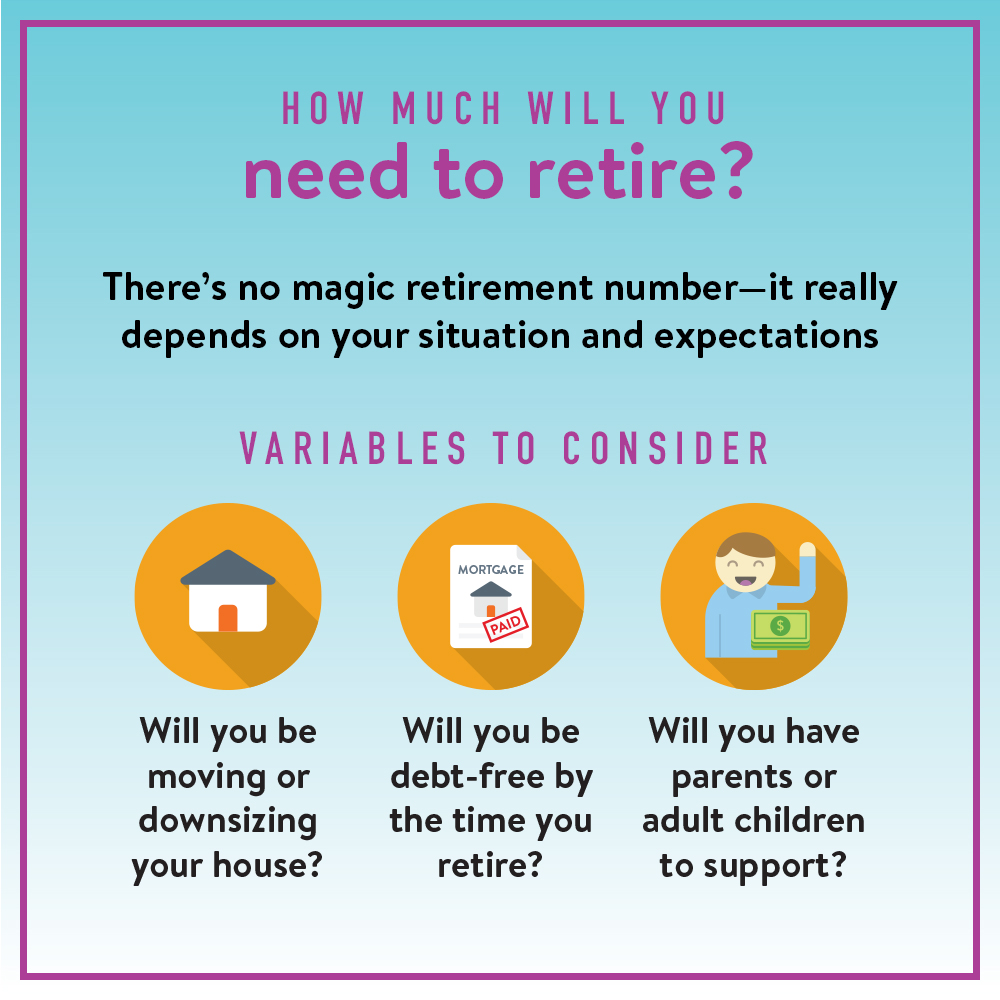

While there’s no one-size-fits-all number for how much you should have saved, asking yourself a few key questions could help you get a clearer picture of where you stand—and what steps you might want to take next.

What’s your current income?

One of the easiest ways to get a feel for how much you might need is by looking at your current income.

A common rule of thumb is to aim for anywhere from 60% to 90% of your pre-retirement income each year, depending on your financial situation and goals.

But that’s just a starting point.

For example, if you plan to travel a lot or take up new hobbies, you might need closer to 100% of your current income. On the other hand, if you see yourself living a simpler lifestyle, you might be able to get by with less.

A financial advisor can help you figure out how much you should be saving based on your unique goals.

Meet with a financial advisor >

What do you want your retirement to look like?

Ultimately, your retirement is what you make of it.

Do you see yourself downsizing and living a quieter life? Or, are you dreaming of traveling the world and focusing on your hobbies?

Once you start envisioning it, you can you begin to price it out.

Questions like where you’ll live, whether you’ll work part-time or if you’ll move somewhere new all factor into how much you’ll need.

Free retirement-planning resources just for you >

What will your retirement expenses be?

To get a more accurate estimate of how much income you’ll need, it helps to look closely at all of your potential retirement expenses.

You may find that some costs go down (like a paid-off mortgage), while others (like healthcare and travel) increase. The saying goes, “If you aren’t making money, you’re spending money.” And it applies to retirement.

Here are some expenses to keep in mind:

Inflation and rising costs are also worth considering, so it’s smart to add a cushion to your estimates.

A financial advisor can help you review your expected expenses and make sure they’re as accurate as possible.

How long will you be retired?

Timing is everything. The earlier you retire, the longer your savings will need to last.

Deciding when to stop working is often a balance between your financial situation and your personal goals.

Another important timing factor is how long your retirement might last. Estimating your life expectancy can be tricky, but it’s something to consider when planning how long your savings need to stretch.

While you can’t predict the future, life expectancy calculators based on your health, lifestyle and family history can help you get an estimate.

And with people living longer than ever, it’s better to plan for a longer retirement than to risk outliving your savings.

Avoid these 7 retirement mistakes >

What income will you have?

Once you have a sense of your retirement expenses—and how long you’ll be retired—you can start looking at where your retirement income will come from.

Common income streams include:

- Social Security: How much of your estimated monthly expenses will that cover? You can review your earnings and estimate your benefits on the Social Security Administration website. (Bonus: Here’s what to consider on when to claim Social Security.)

- Pensions: If you have one, how much income will it provide?

- Retirement accounts: This includes your 401(k), IRAs, annuities and other investment accounts.

- Part-time work: Do you plan to work part-time in retirement? If so, how much do you expect to earn?

- Rental income: Don’t forget to consider other income you might have, like rental income.

You can use free tools like AARP’s retirement calculator to get a detailed chart of your income sources and identify potential gaps. The calculator allows you to make adjustments to see how you can help improve your odds of not outliving your money.

Calculate how long your retirement savings will last >

How can you bridge the income gap?

What if your estimated retirement income falls short of your projected expenses? This is where a little strategy—and professional guidance—comes in.

You might have several options to help close the gap:

You don’t have to navigate these big decisions alone. A financial advisor could help you create a strategy that gives you confidence as you head into retirement.