Retirement in sight? Avoid these 7 retirement mistakes

Retirement should be an exciting chapter, full of new possibilities. But it’s natural to feel a bit anxious about the unknowns ahead.

If you’re approaching retirement, you’re probably busy double-checking your plans to make sure you haven’t missed anything.

You’re so close …

The good news? By planning ahead and understanding common retirement mistakes, you’ll be even more prepared. That’s why we’ve rounded up some mistakes to avoid, so you can stay on track and enjoy the future you’ve worked so hard to create. After all, you’ve earned it!

Mistake #1: Failing to work with a trusted financial planner

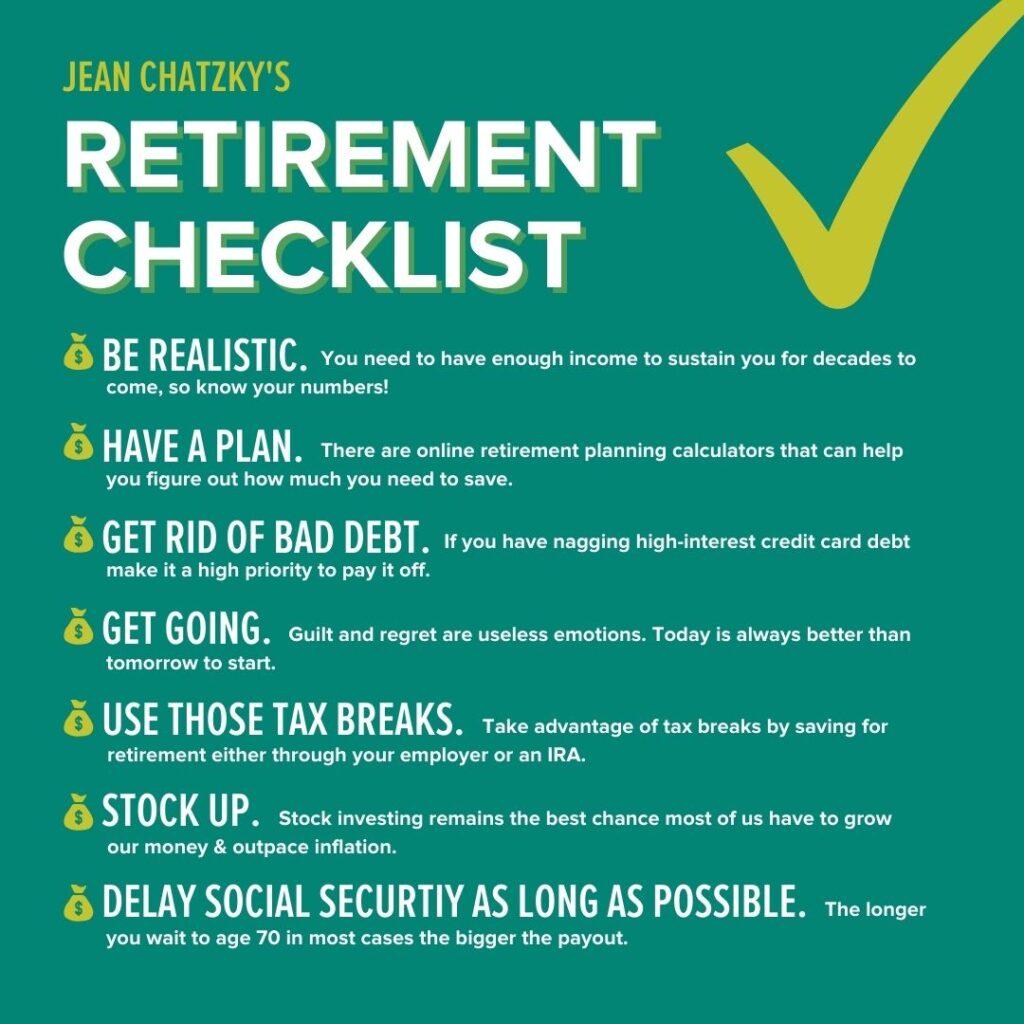

Retirement planning can be overwhelming. Without a clear strategy and expert guidance, you could be setting yourself up for avoidable challenges.

A financial planner can help you create a holistic plan tailored to your unique situation, covering everything from budgeting and debt management to savings and insurance. This kind of expert guidance can help you feel more confident and secure as you approach retirement.

Meet with a financial planner >

How to avoid it

Find a financial planner you trust. You want to feel comfortable being open about your assets, debts and goals. That way, they can help you create a comprehensive plan to pay down debt, maximize your savings strategies, build an emergency fund and ensure you have the right insurance coverage at this stage.

Regular check-ins with your advisor can also help you stay on track and give you peace of mind as your retirement approaches.

Spoiler: Avoiding many of the other retirement mistakes comes back to this important step. The support of a trusted financial advisor can make all the difference!

Here’s some advice from a recent retiree >

Mistake #2: Not calculating how much you’ll need to retire

One of the most common retirement mistakes is not understanding how much you’ll actually need to comfortably retire. Sure, it’s fun—and important—to dream about what you’ll do in retirement. But you’ll also need to get clear on the costs.

You don’t want to get into retirement and realize you haven’t saved enough. And we don’t want that for you, either!

How to avoid it

You can start by asking yourself a few questions:

- What do you want your retirement to look like? Whether it’s travel, hobbies or something else, consider the costs of those activities.

- What are your ongoing expenses? Don’t forget about your home, vehicles, insurance, healthcare and other expenses.

- What income will you have? Will you receive Social Security, a pension or other sources of steady income?

Answering these questions can help you estimate your monthly retirement expenses. Then, subtract your anticipated retirement income. The difference is what your savings will need to cover each month.

A financial planner can help you refine these numbers and create a savings plan that matches your future needs.

Calculate how long your retirement savings will last >

Mistake #3: Retiring too early

The idea of early retirement is tempting. But it can come with financial risks that are easy to overlook.

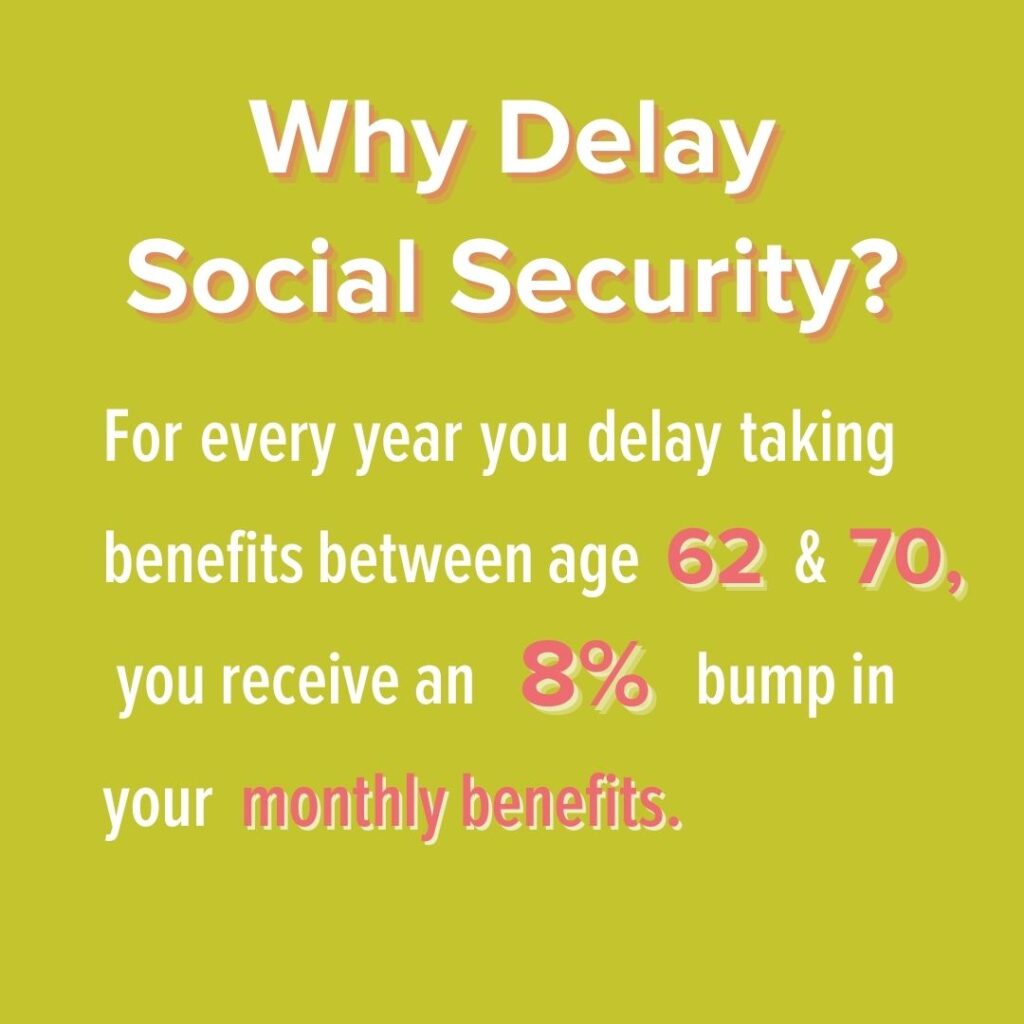

Retiring just a few years too soon could mean reduced Social Security benefits, higher healthcare costs (Medicare kicks in at age 65) and less time for your savings to grow.

The longer you work, the more time you have to contribute to your retirement savings and allow your investments to grow.

How to avoid it

Before making the leap to retire early, consider the full picture.

Review your healthcare costs, Social Security benefits and how long your savings could last under different scenarios. You’ll also want to consider how taxes, market fluctuations and inflation could impact your retirement funds.

We’re just going to say it: A financial planner can help you weigh the pros and cons. You want to feel confident that you’re retiring at the right age for you and your financial situation.

When should you claim Social Security? >

Mistake #4: Retiring with too much debt

Entering retirement with a lot of debt can put a serious strain on your finances.

In fact, nearly half of workers and a quarter of retirees say debt negatively impacts their ability to save for or live comfortably in retirement, according to the Employee Benefit Research Institute’s 2023 Retirement Confidence Survey.

Whether it’s a lingering mortgage, credit cards or personal loans, debt can eat away at your hard-earned savings, forcing you to seek part-time work just to make ends meet.

How to avoid it

There might be debt-repayment options that you haven’t considered!

A financial planner can help you review your current debts, income and retirement goals. They might have suggestions to help you adjust your budget and develop a plan to pay off any lingering debts before you retire.

Remember: Reducing your debt now can give you more financial freedom later.

See how debt can impact retirement >

Mistake #5: Borrowing from your retirement savings or cashing it in

Tapping into your retirement savings early might seem like a quick fix to help cover an unexpected expense. But it can come with serious consequences.

If you withdraw funds from your Individual Retirement Account before age 59½, you could face Internal Revenue Service penalties and taxes that reduce your nest egg. And taking a loan from your IRA halts future contributions until the loan is repaid.

Learn more about these IRS rules >

Many people who cash in or borrow from their retirement savings struggle to catch up.

How to avoid it

Before touching your retirement savings, it’s worth exploring other options:

- Could you take out a loan from your financial institution?

- What about selling non-retirement assets?

- Can you pause contributions temporarily and use that cash for immediate needs?

If you’re unsure of the best path forward, it can be helpful to meet with a financial advisor to help you find other ways to access cash without jeopardizing your retirement funds.

Meet with a financial advisor >

Mistake #6: Not checking in on your investments

Your investment portfolio isn’t a “set it and forget it” kind of thing. Over time, market fluctuations can shift your asset allocation. What once was a balanced portfolio may now carry more risk than you’re comfortable with.

If you’re not regularly checking in, your investments may no longer align with your risk tolerance, retirement timeline or financial goals.

How to avoid it

Review your portfolio regularly with a trusted financial advisor—especially as retirement approaches—to ensure it’s still in line with your objectives.

A financial professional can help you evaluate your risk tolerance, review fees and help you decide whether you should adjust your investments.

Meet with a financial advisor to review your investments >

Mistake #7: Ignoring your credit

As you approach retirement, it’s tempting to think that your credit score becomes less important. But the truth is, your credit can still play an important role in your overall financial health.

If your score drops, you could end up paying higher interest rates on loans or credit cards, which can eat into the savings you’ve worked so hard to build.

How to avoid it

Even if you don’t plan to borrow money in retirement, keeping an eye on your credit score to ensure it’s healthy is always a smart move.

Monitor your credit for free >

Life can be unpredictable, and having a strong credit score ensures you’re financially prepared for whatever comes your way.

The same credit-building rules still apply: Pay your bills on time, keep your credit utilization low and avoid closing those long-standing accounts that contribute to your credit history.