62, 67 or 70: When should you claim Social Security?

As you approach retirement, you’ve probably wondered when to start taking your Social Security benefits.

It’s a big decision.

“As you approach retirement, how long you work and when you claim will usually have a far greater impact on how much income you’ll have in retirement than how much you save or how you invest,” according to The Social Security Claiming Guide by the Center for Retirement Research at Boston College.

But since everyone’s situation is unique, there’s no one-size-fits-all answer.

Retirement could last longer than you expect, so making the right choice can help ensure your financial comfort in the years ahead. That’s why understanding how Social Security works and what it means for your financial future is so important.

Social Security is a key piece of the retirement puzzle, but it likely won’t be enough on its own. It typically covers about 30% of your income after age 65, according to the Social Security Administration.

So, how do you figure out the best time to claim Social Security? Let’s explore some important factors to consider as you make this decision.

Weigh your options with a financial advisor >

How your earnings are calculated

Since the day you started working, the Social Security Administration has been keeping track of your earnings.

These earnings eventually help determine your benefit amount. Your benefits are based on the monthly average of your 35 highest earning years.

Don’t have 35 years of reported earnings? A zero is used for any missing years—ultimately reducing your benefits.

It’s a good idea to review your earnings history periodically to make sure there are no errors that could shortchange you down the road. You can review your earnings and estimate your benefits on the Social Security Administration website.

If you have zeros listed on your earnings record, you could consider working longer to help increase your average earnings (and benefits). Hint: Only wage earnings from a job will boost your Social Security earnings—income from investments don’t count.

Earnings at any age—whether you’re 55 or 95—count on your Social Security record. In fact, many people who continue working into their 70s earn greater amounts than they did earlier in life, which can positively impact their benefits going forward.

This is because the benefits you’re entitled to get recalculated every year. And cost-of-living adjustments are announced each year in October for the following January. If there’s negative inflation, your Social Security benefits will not decrease.

When you can start claiming benefits

The earliest you can claim Social Security benefits is age 62. But if you take Social Security early, your benefits are reduced permanently. (You will still receive cost-of-living adjustments.)

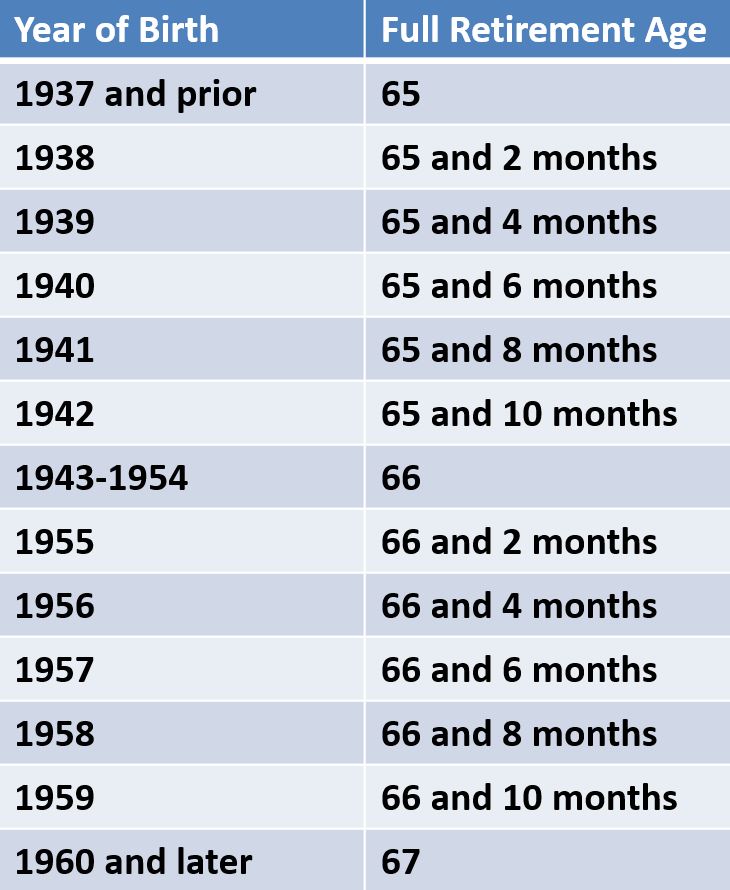

You’re entitled to full benefits when you reach your full retirement age, which depends on your birth year. If you were born in 1960 or later, your full retirement age is 67.

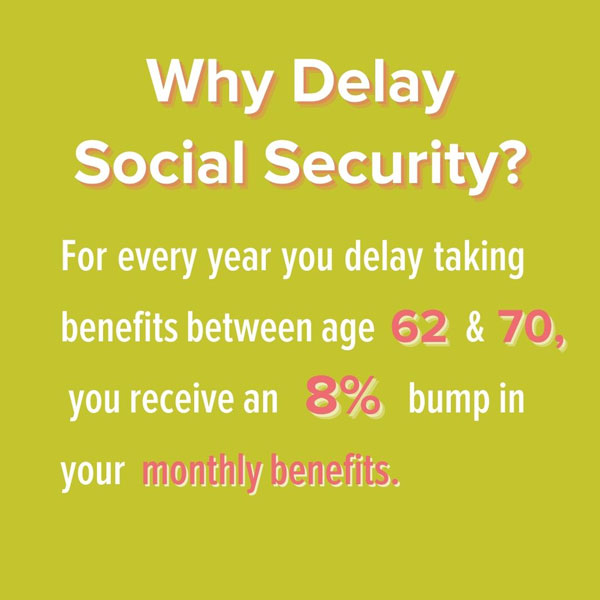

You can also hold off on taking your benefits when you reach your full retirement age—up to age 70—to receive delayed retirement credits. For every year you wait after your full retirement age, your benefits increase by 8%.

So, if your full retirement age is 67 and you wait to claim your benefits at age 70, your payments could be 24% more than they would’ve been at 67. Over the course of your retirement, this could significantly increase your lifetime earnings.

Delayed retirement credits cap at age 70, so there’s no advantage to waiting any longer.

Even though waiting could mean bigger payments, 62 is the most popular age to claim Social Security benefits. In 2020, about 23% of men and 25% of women filed for benefits at that age, according to the Social Security Administration.

Another popular age to claim benefits? Age 65, when you’re eligible for Medicare coverage. Many may find it easier to pay for Medicare once they’re drawing Social Security, because Medicare premiums can be automatically withdrawn from their benefits.

But if you aren’t getting Social Security benefits yet, you’ll just get a monthly bill for your Medicare to pay just as you would any other insurance premium.

Estimate your benefits with these Social Security calculators >

Waiting to claim Social Security

One school of thought is to wait as long as possible before taking Social Security benefits. The longer you wait, the larger your potential payouts could be.

A study published by the National Bureau of Economic Research looked at workers between ages 45 and 62. Researchers found that almost everyone would come out ahead financially if they waited until at least age 65.

If those workers could hold out until age 70? They could increase their lifetime payout by over $180,000.

Some might only gain a few thousand dollars by waiting. But for those at the higher end of the income scale, the difference can be more than $900,000 over the course of retirement.

But life happens. Some people file early because they need the money now. Others file early because of health concerns.

Meet with a financial advisor >

Collecting Social Security and working

Claiming Social Security benefits and retiring aren’t the same thing. You can keep working while you receive benefits.

But if you’re working and claim your benefits before your full retirement age, some of your benefits might be withheld. The amount withheld depends on your age and how much you earn. This is called the retirement earnings test.

Basically, the more you earn over a certain threshold (adjusted annually for inflation), the more benefits you’ll have withheld. Here’s how it works:

- In 2023, if you earn more than $21,240 in a year before your full retirement age, you’ll lose $1 in benefits for every $2 earned over the limit.

- In the year you turn your full retirement age, you’ll lose $1 in benefits for every $3 earned over $56,520.

- Once you reach your full retirement age, the earnings test no longer applies. And no benefits will be withheld.

But don’t worry—this isn’t a permanent loss. Once you reach your full retirement age, your benefits will be adjusted to make up for the months when they were withheld.

When to claim your benefits

Deciding when to start collecting Social Security can have a big impact on your retirement income. But how do you know when it’s the right time for you?

It’s important to consider your health, other sources of retirement income, retirement goals and more before making your decision. Talking to a trusted financial advisor can help you review your unique situation.

But here are some factors to consider:

- Health concerns: Are you experiencing any health issues that might limit your lifespan or increase your medical expenses?

- Family history: Do you have a family history of health conditions, or have family members typically lived long lives?

- Your breakeven age: Have you calculated your breakeven age? This is the age at which you’ll have received the same amount in benefits whether you started early or delayed. (A financial advisor can help you estimate this.)

- Rising expenses: Have your living costs increased? Or, are they still manageable? Do you anticipate any large expenses soon?

- Retirement plans: Are you ready to retire, or do you want to continue working a few more years? What’s the primary reason you’re still working?

The bottom line: Don’t rush into claiming Social Security early because you’re worried. If you don’t need the income right away, take some time to weigh your options. And remember, a trusted financial advisor can help you with this process.

Meet with a financial advisor >

How to apply for Social Security

When you are ready to apply for your benefits, you have a few options to get started. You can:

- Apply online on the Social Security Administration’s website.

- Call the Social Security Administration at 800-772-1213.

- Visit a Social Security Administration office.

This is intended for educational purposes only. When considering your Social Security benefits, consult a trusted financial advisor who specializes in tax planning to help you make the optimal decision for your situation.