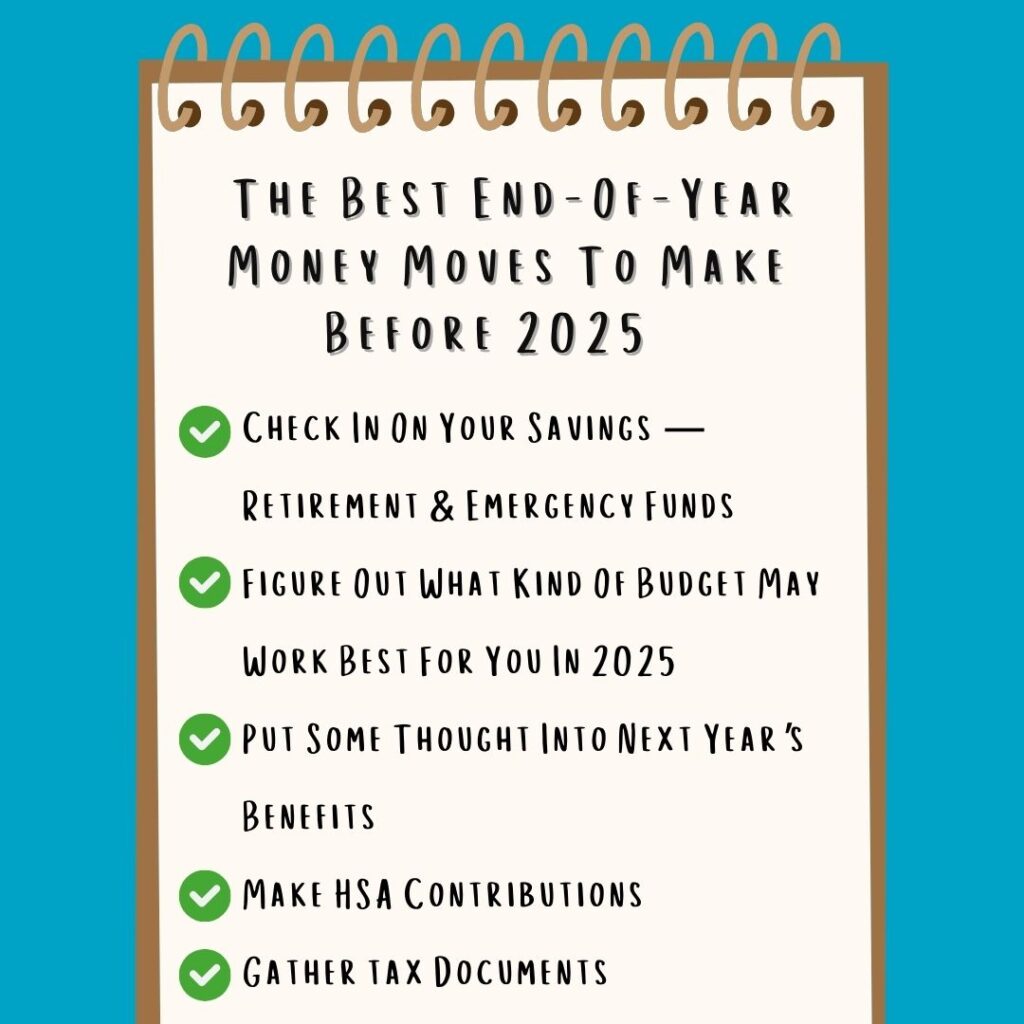

Your financial check-in: The best money moves to make now

As one year wraps up and another begins, it’s the perfect time to pause and take a closer look at your money. Think of it as a financial check-in.

It’s not about perfection—it’s about understanding what worked, what didn’t and what you want to focus on next.

Every year is a little different. Maybe you got a raise, got married, welcomed a new baby or faced an unexpected expense. But even with life’s curveballs, many of our habits—good and bad—tend to stick with us.

When you look back at the past year, did you:

- Save as much as you’d hoped?

- Spend more than you’d budgeted?

- Pay down the debt you were hoping to eliminate?

Whatever your answers are, now’s the time to check in and see where there may be room for improvement in the year ahead. Here’s a checklist to help you get started.

Look at your retirement savings

Take a moment to check your progress toward your retirement goals.

Look first at employer-sponsored plans, like a 401(k) or 403(b), as those tend to come with matching dollars. Are you taking full advantage of any matching funds? That’s essentially free money!

Don’t have access to an employer plan? Consider opening an IRA and contributing as much as you can.

You can make 2024 IRA contributions until April 15, 2025, according to the Internal Revenue Service. Check with your tax advisor to verify your eligibility and contribution limits.

For both the 2024 and 2025 tax years, total IRA contributions are limited to $7,000 ($8,000 if you’re age 50 or older) or your earned income for the year—whichever is less.

Don’t let maximum contribution amounts discourage you. Instead, let them inspire you to shoot for saving as much as your budget allows.

The goal is that every year—as you receive raises or earn more money—you’ll increase the percentage of your income that you contribute, so you can save as much as possible.

Make it easier to save by automating it >

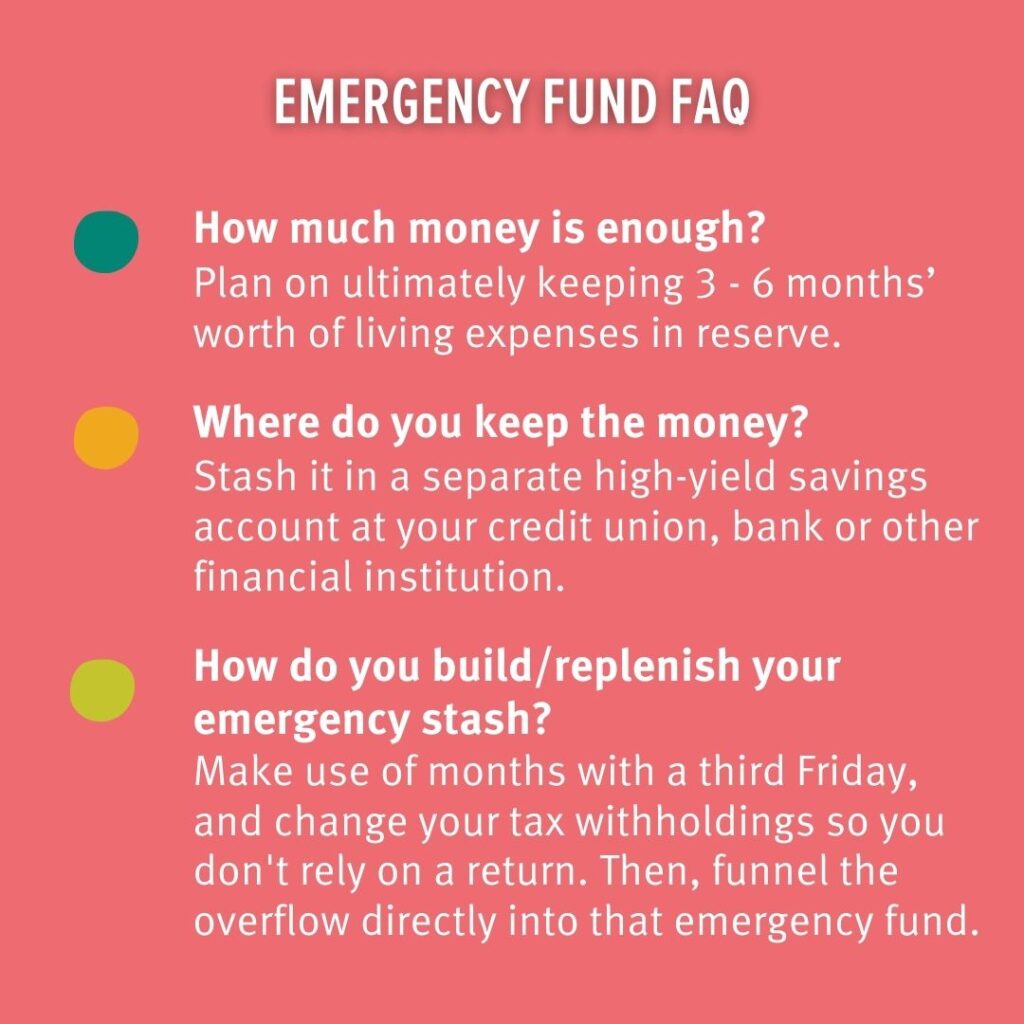

Review your emergency savings

How’s your emergency fund looking?

The general rule of thumb is to keep three to six months’ worth of living expenses set aside. But don’t panic if you’re not there yet.

Research from the JP Morgan Chase Institute suggests that when people need to tap into their emergency funds, they usually only need access to around six weeks’ worth of take-home income at one time.

Unlike your retirement assets, your emergency fund should be stashed in a separate high-yield savings account. Having that money close (but not too close) helps prevent you from reaching for it in your everyday life. That way it’ll be there for you when you need it!

Build your emergency fund like a pro >

Find a budget that works for you

If you don’t already have a budget, now’s a great time to create one.

A good budget gives you a clear picture of how much money is coming in and going out each month—and where it’s going.

There are countless budgeting methods, like zero-sum budgeting. Pick one that works best for you!

And if you need help getting started, you can get one-on-one guidance with a free Dupaco Money Makeover.

Request my free Money Makeover >

Give your benefits some thought

Before your employer’s open enrollment ends, take a close look at your employee benefits. The last thing you want to do is let the open enrollment deadline creep up on you, and then be forced to make a split-second decision on the benefits you need.

Even if you’re happy with your health plan, it’s worth revisiting your options, as premiums and coverage can change year to year.

Consider your family’s expected medical expenses and medications, as well as the doctors included in your plan’s network.

If you have a partner who’s eligible for health insurance through their employer, compare policies to see which offers the best value for your household.

You’ll want to look at all the benefits offered by your employer and make sure you’re not leaving anything on the table. There may be benefits you didn’t even know about!

If you’re eligible, make HSA contributions

If you use a high-deductible health insurance policy, you could be eligible to contribute to a Health Savings Account.

HSAs are amazing savings vehicles.

First, all contributions you make to an HSA are either pre-tax (if you make them through your employer) or tax-deductible (if you’re making the contributions on your own).

Also, the money you save grows tax-deferred, and it can be used tax-free for eligible medical expenses at any time. In other words, money in an HSA equals big tax savings for you!

Unlike a Flexible Spending Account (FSA), you don’t have to use the money in an HSA by a certain deadline—the money is yours to use forever. Your HSA contributions can be used for health insurance deductibles, copayments, dental or vision care, prescription drugs and over-the-counter medications at any point throughout your life.

You can open an HSA on your own if your health insurance policy qualifies. The limits on how much you can contribute to your HSA in 2025 are $4,300 for individual coverage ($5,300 if you’re 55 or better) and $8,550 for family coverage ($9,550 if you’re 55 or better).

Open my Health Savings Account >

Use those flex spending dollars

Use a Flexible Spending Account instead? FSAs are plans offered by employers that let you set aside pre-tax dollars to cover medical expenses.

You’ll want to check your balance and use any remaining funds before your spending deadline, which is usually Dec. 31. Confirm your spending deadline with your plan administrator.

Most people think of using their FSA for things like deductibles, copays, dental care or prescriptions—and those are great options! But the list of eligible expenses might be longer than you realize.

Start gathering documents for tax season

Getting a head start on tax prep can save you headaches later. You can organize what you’ll need into three main categories:

Personal information

Think Social Security numbers or tax ID numbers and birthdates for you and any dependents on your tax forms.

You likely already have these on hand. But if you’ve had a new baby, adopted a child or gotten married, this is a great time to gather those details.

Income documents

Keep an eye out for income documents.

If you’re classified as an employee, this will be a W-2. But for contractors or freelancers, you’ll watch for 1099s. Both W-2s and 1099s reflect how much you’ve earned over the course of the year.

Also, depending on your earning and employment situation, you may have a 1099-INT for interest income, a 1099-G for unemployment benefits, a 1099-R for retirement, IRA and annuity income, or 1099-misc for miscellaneous items.

It’s good to go over a month-by-month mental checklist for everything you earned during the year to make sure you haven’t forgotten anything that’s due to come in the mail—or that you might need to print.

Tax deductions

Gather documents for tax deductions that you plan to take. You might need:

- Homeownership records, like a 1098 for mortgage interest, property tax and insurance statements

- Charitable deductions, like receipts for cash or donated items

- Childcare and education expenses

- Medical insurance and medical expenses

Progress over perfection

Remember, an annual financial check-in isn’t about being perfect—it’s about progress. Whether you’re building savings, tackling debt or just getting organized, every small step counts.

And you don’t have to tackle all of these at once. Check off one task at a time, celebrate your wins and give yourself grace for the rest.

Here’s to starting the year with a plan that works for you and your goals!