The ultimate guide to choosing the right financial advisor for you

Unless you work in finance—and even if you do—you probably have some questions about the best moves to make with your money.

Questions like … How do I balance saving for retirement with paying down debt? Which investments could help me retire earlier? Am I saving enough for retirement?

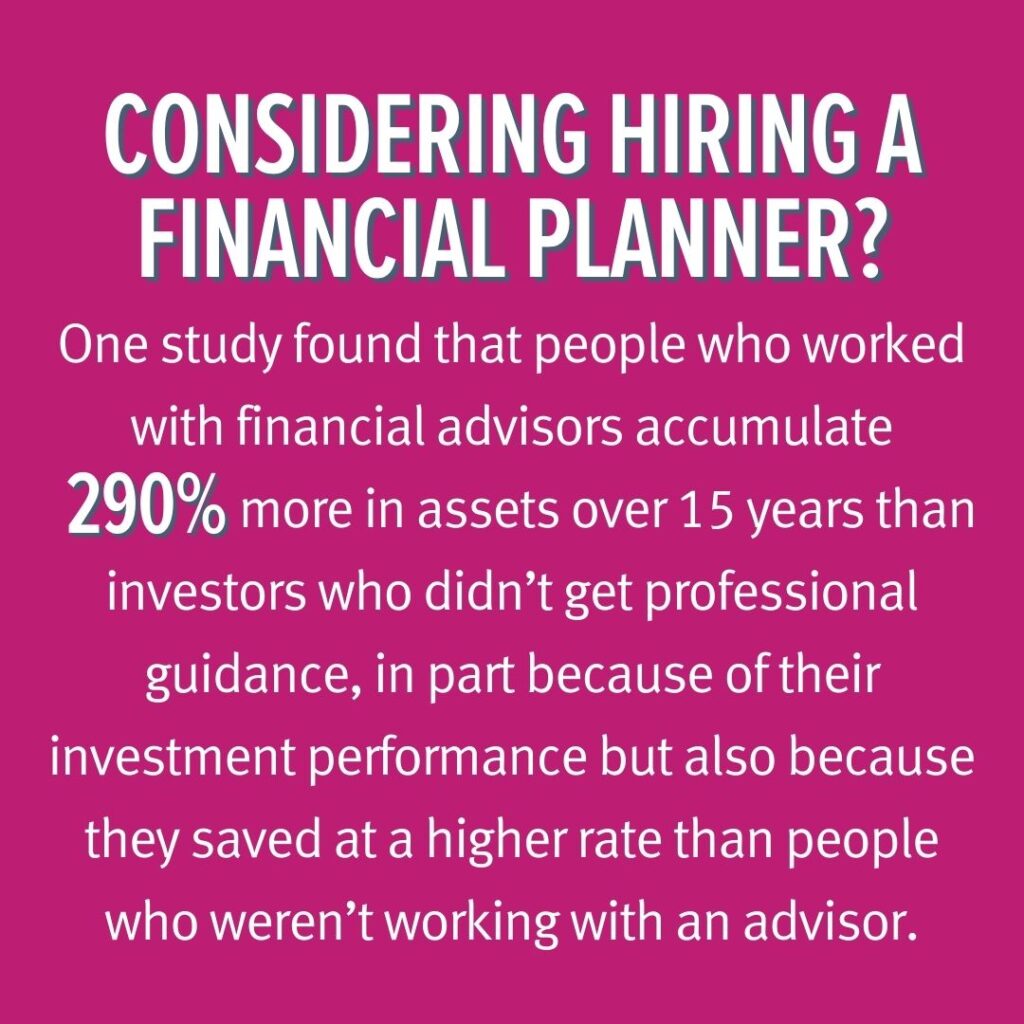

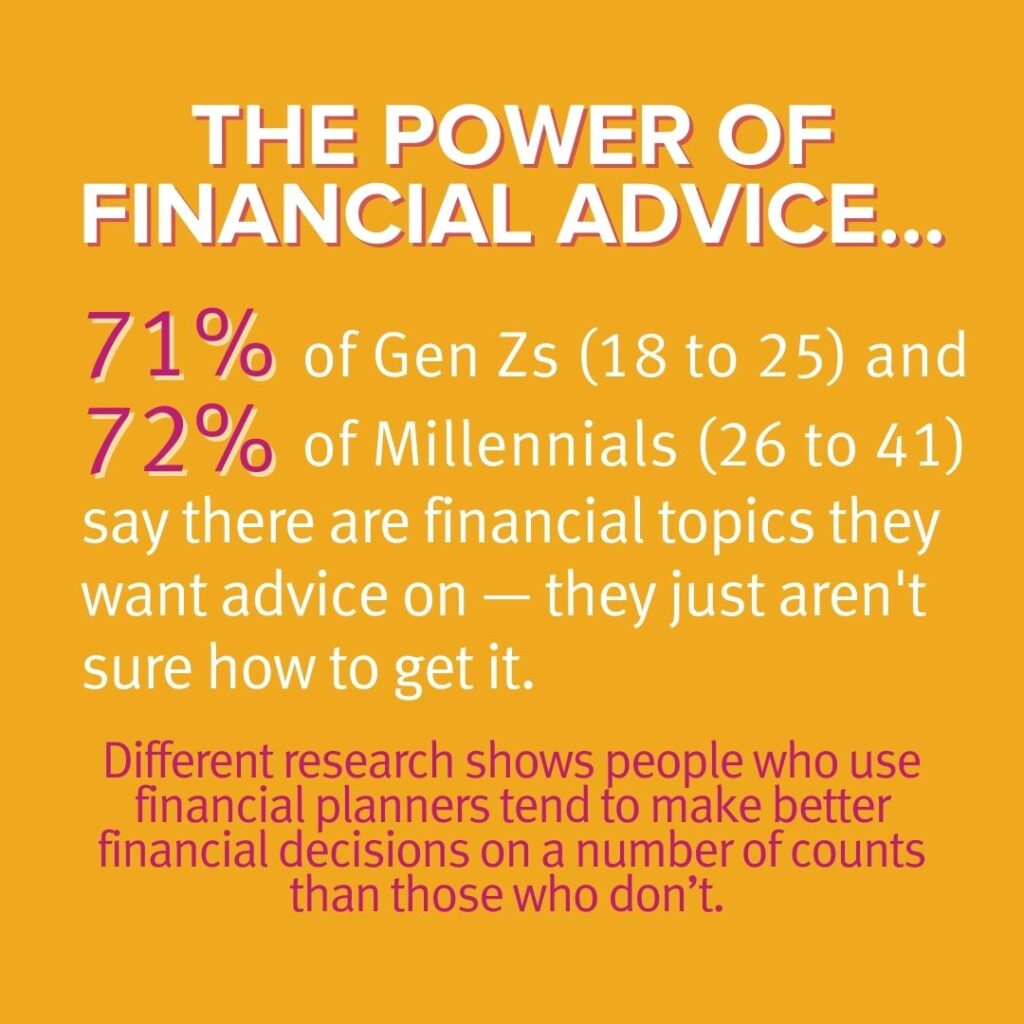

If these questions sound familiar, it might be time to consider working with a financial planner.

They can offer valuable advice on investments, retirement planning and more. And you don’t need millions in assets or a complicated financial situation to benefit.

In fact, the sooner you start working with someone you trust (even just a yearly check-in), the sooner you could feel more confident about your financial decisions.

But how do you choose the right financial advisor for you?

How a financial advisor can help you

The first step in choosing an advisor is understanding your financial goals. That will help shape the relationship and clarify how they can help you.

Financial planners can:

- Help you understand your risk tolerance as an investor.

- Serve as a trusted sounding board for your major financial decisions, like how to invest for your specific goals and time horizon, and how and when to draw down retirement accounts.

- Help you build healthy financial habits, like establishing an emergency savings fund, maximizing tax benefits and making the most of employee benefits, like a 401(k).

- Offer clarity if you’re juggling multiple goals—like paying down debt while saving for college, or covering family expenses while investing for retirement.

Which type of financial planner is right for you?

Under the “financial advisor” umbrella, there are several types of professionals, each with their own focus, experience and certifications.

Here’s a look at some of those designations:

Financial planner

A financial planner can guide you on everything from retirement and estate planning to budgeting and insurance. While anyone can technically call themselves a “financial planner,” there are certifications that signify specialized training.

Certified Financial Planner (CFP)

This financial planner has completed extensive coursework and passed a rigorous exam. CFPs must have several years of experience, pass a background check, follow an ethics code and adhere to the fiduciary standard, which means always putting their clients’ needs first.

Chartered Financial Consultant (ChFC)

ChFCs also receive rigorous training and must pass multiple training modules. They aren’t required to follow the fiduciary standard, so they may earn a commission on the products they offer. They can specialize in areas like divorce or small business financial planning. Sometimes, financial pros hold both CFP and ChFC designations.

Registered Investment Advisor (RIA)

RIAs focus on managing investments and must pass an exam and register with the SEC. RIAs are legally required to act as a fiduciary for their clients. They can create a portfolio aligned with your goals and risk tolerance.

Wealth manager

Wealth managers often work with high-net-worth clients who require ongoing financial management. Certifications include Wealth Management Certified Professional and Wealth Management Specialist. Many advisors who charge a percentage based on the assets they manage call themselves wealth managers.

Meet with a financial advisor >

Essential questions to ask a financial planner

Once you know what type of financial advisor you’re looking for, it’s time to find the right fit.

You’ll want to set up meetings with each one you’re considering. And remember, your initial consultation should be free!

Here are some questions to ask:

Are you a fiduciary?

Fiduciary advisors must always put their clients’ interests before their own, with no conflicts of interest.

How do you get paid?

While “How do you get paid?” may feel direct, it’s an important question. This helps you compare your options and understand the full cost per advisor, per year. Advisors are often paid in one of these ways:

- Hourly: You and your advisor can discuss their hourly rate and what they can accomplish within your budget.

- Flat fee: Some advisors charge a set payment based on the services they provide.

- AUM, or “assets under management”: Some advisors may charge a percentage of the assets they manage. The industry average fee is around 1%, but this can vary. Generally, the more money they manage, the lower the percentage fee will be.

- Commission: Make sure you understand any commissions or fees baked into the investments you purchase, as these are costs you’re covering.

What can you tell me about your client base?

Ask about their client experience, specialties and the diversity of their clients. Do they typically work with entrepreneurs, small business owners or manage assets as large or modest as yours?

If they’ve never worked with someone in your exact situation, talk to them and see what their guidance would look like.

What kind of guidance and financial plan can I expect?

A good advisor will create a customized plan for you that’s informed by their market experience. Ask them to walk you through their approach so you know what to expect.

What’s the best way to reach you?

Knowing their preferred mode of communication can help you feel supported and know what to expect. Whether they prefer email, phone, virtual or in-person meetings, find someone whose communication style aligns with yours.

How often will I hear from you?

Talk about their communication frequency to ensure it meets your needs. If they work with a team, ask if you’ll hear from them directly or another team member.

Is it the right time for a financial planner?

Only you can decide when or if you’re ready for a financial planner.

If you’re not ready to work with one now, you can still take advantage of other resources and tools designed to help you make the most of your money now—and in the future.

Here are some free resources to help you get started: