How to ‘trick’ yourself into saving more

With inflation high and money tight for so many of us, there’s never been a better time to re-examine how we’re managing our finances and to make some moves to save more.

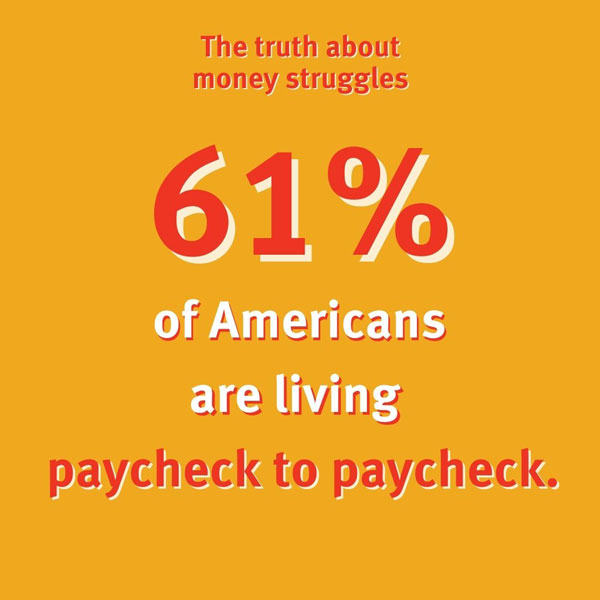

Some 61% of Americans—203 million people—are living paycheck-to-paycheck, and 13% of us are spending more than we earn.

Not only is this causing us stress in the here and now, but it’s also leading to lasting regrets for the future.

Nearly 70% of Americans have financial regrets, including not saving soon enough for retirement, having credit card debt and not having an emergency fund.

Build your emergency fund with these tips >

The easy part, of course, is recognizing that we need to change our habits. The more challenging part is making the changes and then actually sticking to them.

Researchers may have an answer.

Hint: It has to do with thinking small.

What the study found

A study from the University of California, Los Angeles and the University of London (published in the INFORMS journal, Marketing Science) applied a behavioral finance trick known as “mental reframing” with success.

They conducted a study with 2,000 customers of a personal finance app that allows users to save and invest small amounts of money. New users who signed up for a recurring deposit program were randomly offered the choice of committing to deposits of $150 monthly, $35 weekly or $5 daily.

Here’s what happened: Savers were more likely to commit to—and stick with—a personal savings regimen focused on smaller, daily amounts over the large, intimidating per-month goal. In fact, quadruple the number of people chose to enroll in the recurring deposit program when given the $5-a-day option versus the $150-a-month savings goal.

The appeal of the smaller savings option also leveled the playing field between low- and high-income consumers.

When presented with the $150-a-month savings program, higher-income consumers signed up at a rate of three times that of lower-income consumers. When deposits were framed as $5 a day — which also gets you to $150 after a month—the participation gap was completely eliminated.

Perception—and convenience—matters

It’s not a huge stretch to see why breaking down larger-dollar goals into bite-sized chunks is more digestible.

Big numbers—like saving $1 million for retirement—can feel daunting, even when we fully know amassing enough money for retirement should take decades (and also depends on the investment growth of the money that you save).

One thing that keeps a lot of us on the sidelines is how we measure the opportunity cost of those dollars we don’t have to spend now. Putting away a dollar for tomorrow means one less dollar to spend today.

However, the study’s authors demonstrate the mental calculation of giving up $5 a day is much easier to overcome. It’s a comparatively small sacrifice (giving up a snack or magazine) than mustering up the resolve to part with $150 all at once.

Launchpad helps you save for retirement a little at a time >

Reframe your savings goals

If you’re facing a savings goal that seems insurmountable, cut it down to a less intimidating size with some simple math:

- Save $8 a day to wipe out a $500 credit card balance: Stop letting that lingering balance give you indigestion. You can knock it back to $0 in two months for just the cost of a daily sandwich.

- Save $11 a day to amass a $2,000 emergency fund: Sock away your spare dollars for six months, and you’ll be sitting on a healthy $2,000 cash cushion to soften the blow of any unexpected expenses. Need longer to come up with that amount? A smidge over $5 a day gets you there a year from now.

- Save $19.17 a day to max out your IRA: The IRS allows you to contribute a maximum of $7,000 to a Roth or traditional IRA for the 2024 and 2025 tax years. (It’s $8,000 if you’re over age 50.) You’ll have to save about $580 a month to do it in 12 months.

Calculate the savings over time with a Roth vs. Traditional IRA >

Grab all of your matching 401(k) dollars

And while we’re talking retirement, pretty much the easiest—and most profitable—thing you can do is to make sure you’re taking advantage of any 401(k) (or other retirement plan) dollars your employer is offering.

Many employers match 50% on the dollar up to a certain contribution limit—that represents a guaranteed 50% return on your money.

Plus, it’s free money.

How much?

Well, say your employer—like many—matches 50% of contributions up to 6% of your salary. If you’re making $75,000 a year, you need to contribute 6% ($4,500) to qualify for a 3% ($2,250) match. That $4,500 works out to about $12.30 a day, or $173 every bi-weekly paycheck.

Just remember that if you’re contributing to a traditional 401(k) (instead of a Roth), that money comes out of your paycheck before taxes take a bite. So that $173 will feel like even less.

And the best part about this is that you can set it and forget it—401(k)s and other similar retirement accounts are so effective because the money comes out of your pay before you can see it, touch it or spend it.

PS: If you’re offered a Health Savings Account through work, there may be incentive dollars for participation there too. Make it a point to grab them as well.

Automate for even more savings

Finally, before you wrap—take that automatic 401(k) magic and apply it throughout your life.

Maybe you have a credit card or car payment that’s scheduled for automatic bill pay, and you’ve seen that it’s super convenient.

You can do the exact same thing with your savings, and every month (or week, your choice) you can have a set amount of money automatically moved from your checking account into a savings account. It happens without you having to manually move money, which means your savings will accumulate without you ever having to lift a finger.

Think about it: Wouldn’t it feel nice to ring in the new year without a balance on your credit card from purchasing holiday gifts?

You can get there!

Figure out roughly how much you’re going to spend on the holidays, and divide the amount by the number of months (or weeks) you want to give yourself to reach the goal. Then, you’ll set up an automatic transfer of that exact amount to go into a dedicated holiday savings account.

Before you know it, the money will be there for you when you need it, all because of your bite-sized savings goal.

And if this sounds like something you’d like a little help with, schedule your free Dupaco Money Makeover to help you get started.