Dupaco’s Mary Heavens visits with a member visiting a Dupaco branch in Cedar Rapids, Iowa. (B. Kaplan photo)

Dupaco’s Mary Heavens visits with a member visiting a Dupaco branch in Cedar Rapids, Iowa. (B. Kaplan photo)

Dupaco is a thrifty refuge from payday lenders

Trying to avoid payday lenders? Dupaco helps members in a short-term pinch and coaches them to the goal of financial independence.

That’s because we’re a not-for-profit cooperative, where people are worth more than money.

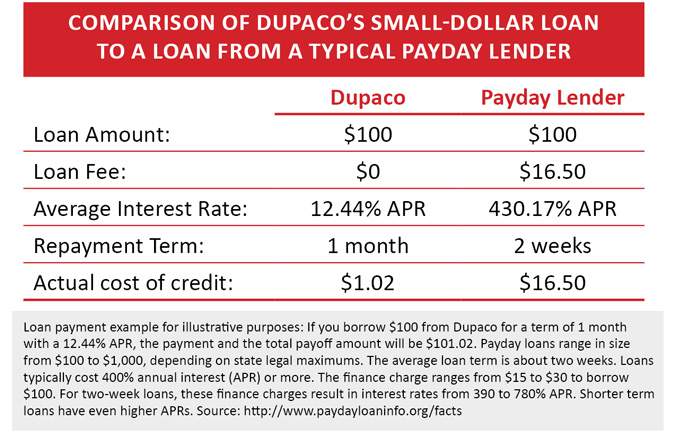

More than one out of four loans made by Dupaco is a small-dollar loan of $2,500 or less. In 2019, Dupaco made 8,016 loans that were for $2,500 or less.

Loans $2,500 and less: | Loans $500 and less: |

|---|---|

Number of loans made: 8,016 | Number of loans made: 2,167 |

Average loan balance: $1,133 | Average loan balance: $438 |

Average interest rate: 13.25% APR | Average interest rate: 11.42% APR |

Loan fees charged: $0 | Loan fees charged: $0 |

Repayment terms: Flexible | Repayment terms: Flexible |

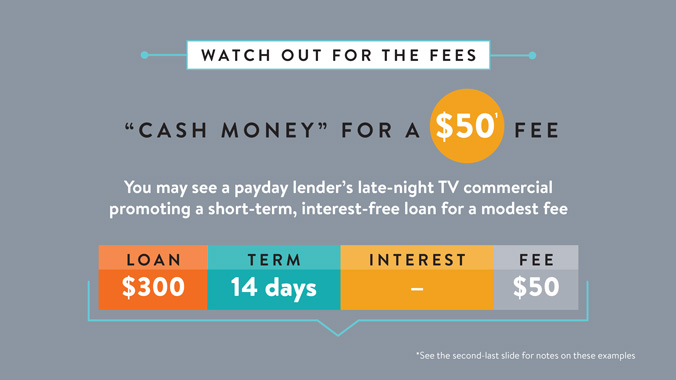

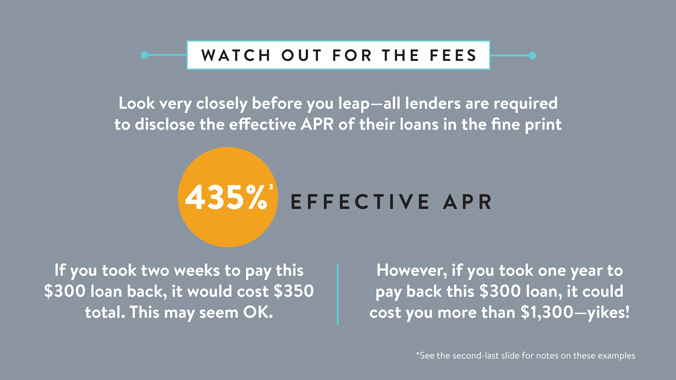

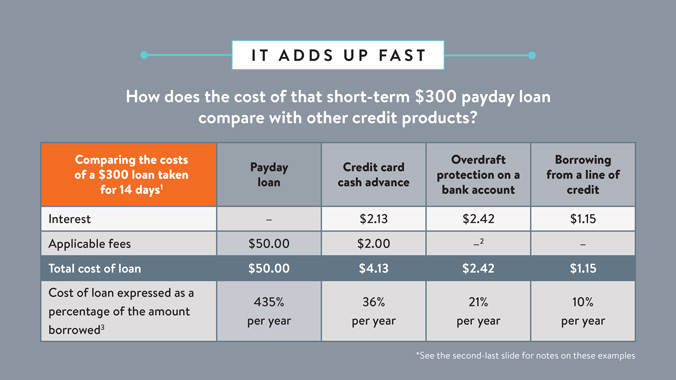

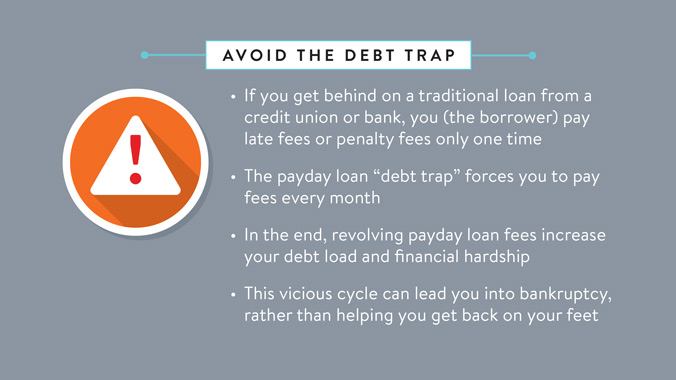

By setting up loans with easier repayment terms, Dupaco can help you stop the borrowing cycle. Payday lenders might argue that the annual percentage rate is misleading, because loans are often paid back within two weeks. But if you’re unable to repay the loan in full, the cost of your loan escalates. Your loan is then rolled into a new one. And if this continues, your original payday loan becomes expensive and starts a cycle of debt

If you are facing debt problems, you may feel that a payday lender is your only option. Not true—you have a number of alternatives to taking out a high-cost payday loan. Download this checklist to evaluate your options.

Interested in opening a loan with Dupaco? Apply online in minutes, or contact the consumer loan department by emailing loans@dupaco.com or by calling 800-373-7600, ext. 305.