Opening your first credit card? Don’t forget to do this

Your first credit card can be a powerful tool.

When used correctly, it helps you build your credit. The higher your credit, the closer you are to reaching your goals—homeownership, a new car, you name it.

But with any credit card, one money-smart move remains key—saving.

Why saving matters even more with your first credit card

Credit cards come with good news and bad news:

While it’s easy to use your new credit card for planned purchases, it’s also tempting to charge impulse buys.

When it comes to having a credit card, it doesn’t make budgeting less important. It makes it more important.

Make room in your budget to pay yourself first. An emergency savings account helps ensure you have money available when the unexpected happens.

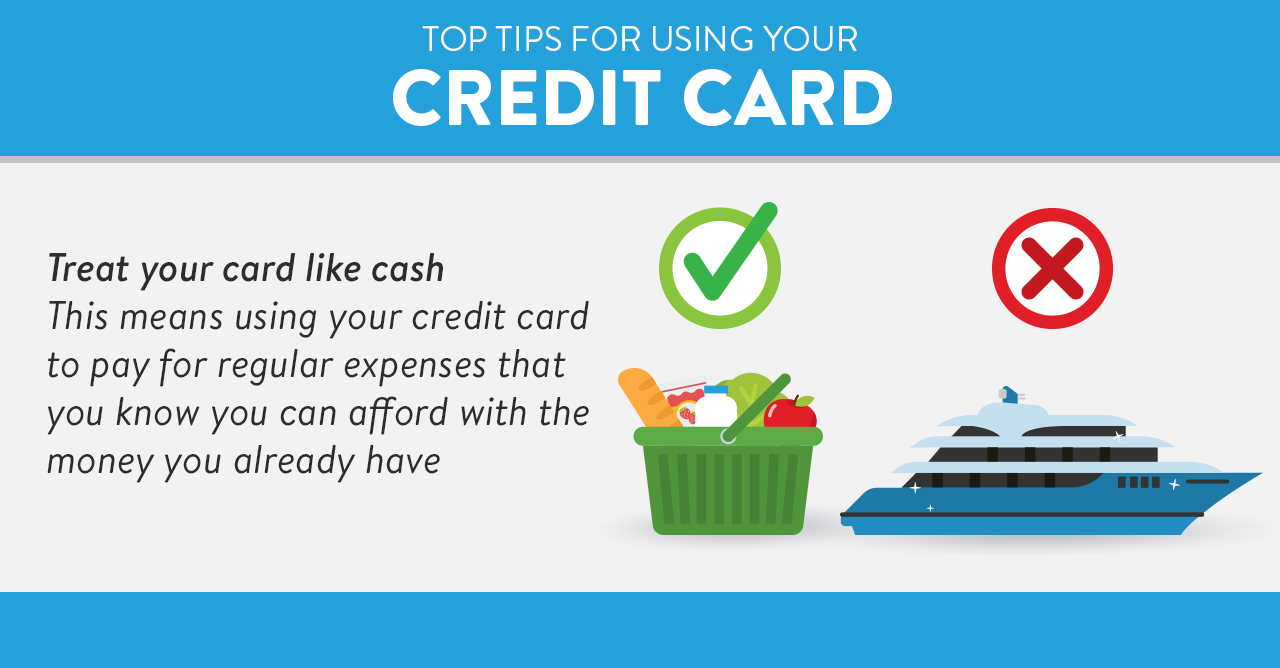

The goal: Only use your credit card for purchases you can pay off each month.

When you use your card and can’t pay off the balance, you start paying interest on it. And then you still have the normal expenses you used your card for before. It’s a spiral that can be hard to stop.

Learn how to stick to your budget with your credit card >

Tips to help you save

Thankfully, saving doesn’t have to be complicated! Especially when you use the tools available within Shine Online and Mobile Banking.

Here are a few ways you can start saving more to prevent using your new credit card for unplanned expenses:

- ChangeUp Savings: Have your “loose change” from debited transactions automatically deposited into your savings account with ChangeUp Savings. You can activate or deactivate the feature anytime in Shine.

- Automatic transfers: Specify how much and how often you want to save, and Shine will do the rest, helping you make saving a priority.

- You-Name-It Savings accounts: When saving for something specific, like emergencies or vacations, it helps to set money aside just for that purpose. Using separate You-Name-It Savings accounts (that you name!) makes it easier to protect money for your specific goals.