Home equity loan or line of credit: Which is right for you?

By Georgia Slade | Assistant vice president, lending process analyst

Your home can be a powerful asset long before you sell it. By borrowing against the equity in your house—through a home equity loan or home equity line of credit—you can consolidate debt, fund home improvement projects or pay for other expenses.

While both types of loans require you to have equity in your home, their terms are different. Understanding how each loan works can help you determine which option makes sense for you.

Home equity defined

Home equity is the difference between your home’s fair market value and the outstanding balance of all liens on your property. In other words: It’s the part of the house that belongs to you, not your lender.

Your equity should increase over time as you pay down your mortgage balance. You can build equity even quicker by paying off your mortgage biweekly. When you pay down your balance every other week, you end up making one extra monthly payment each year—ultimately owning even more of your home.

Your equity also can increase as home values in your area go up.

Calculate your home equity with our calculator >

How home equity loans and HELOCs are similar

With a home equity loan and a home equity line of credit, you’re able to access the equity you’ve built up in your home while you still live there.

Both types of loans are considered a second mortgage on your house. With both, you’re borrowing against your equity. You’re using your home as collateral, which helps protect your lender. That means if you default on your loan, your lender can seize your home and sell it to attempt to recoup its losses.

Because you’re using your home as collateral, these loans typically offer much lower interest rates than personal loans or credit cards.

Once you have a home equity loan or home equity line of credit, you can use the funds for whatever purpose you choose, including:

- Debt consolidation: Transfer and combine your loan and credit card balances into one loan, potentially lowering both your interest and monthly payment.

- Home improvement: Many projects, such as a kitchen or bathroom remodel, can increase the value of your home—in turn boosting your home’s equity.

- Anything at any time: Use the funds for an emergency, a vacation or something else.

Either loan will show up on your credit report as another open trade line. If you maintain a positive payment history on your loan, it can help your credit score.

You’ll need to consult your tax advisor to determine whether you’ll qualify for a tax deduction with a home equity loan or home equity line of credit.

Estimate the impact of consolidating debt >

How home equity loans and HELOCs differ

Dupaco offers both a home equity line of credit and a home equity loan.

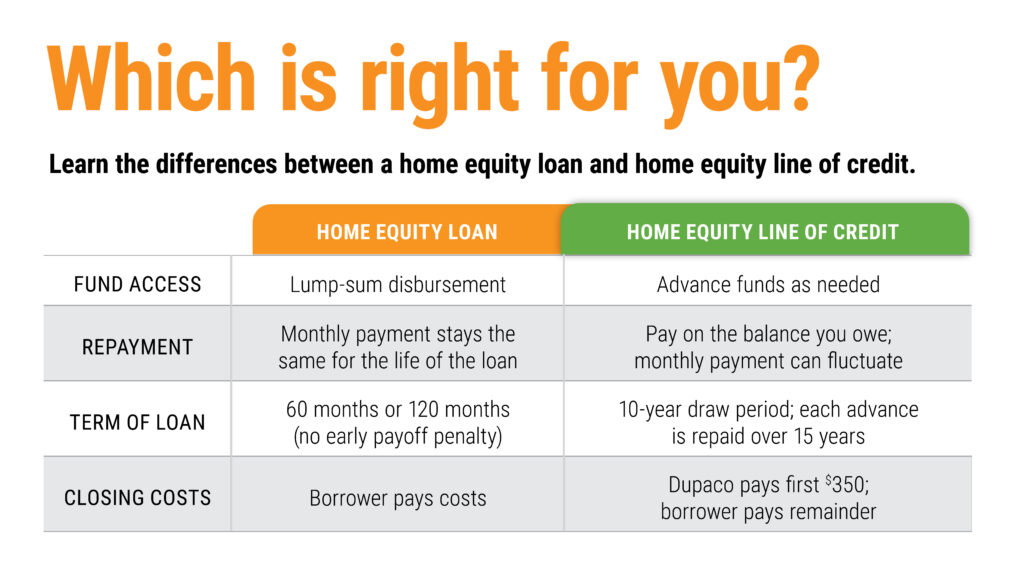

While a home equity loan and home equity line of credit share some things in common, their terms are quite different. Here’s a breakdown of the main differences between Dupaco’s two home equity options:

Accessing the funds

- Home equity loan: You receive the funds in one lump-sum—regardless of whether you need all of it at that time.

- HELOC: You withdraw funds when you need them. You can access the funds through Shine Online or Mobile Banking, by calling Dupaco at 800-373-7600, visiting a Dupaco branch or writing a check from your HELOC account.

Repaying the funds

- Home equity loan: Your monthly payment remains the same throughout the life of the loan, which is a 120-month (10 years) or 60-month (five years) term. At Dupaco, you have the option to make weekly or biweekly payments to pay off the loan even faster.

- HELOC: Repayment works like a credit card—borrow what you need, pay it off and borrow again. You have 10 years to withdraw money from your line of credit. Each time you take an advance, you have 15 years to repay it. In theory, you could leave the line of credit untouched for nine years, take a full advance at that time and then have 15 more years to repay those funds. Unlike a home equity loan, your monthly payment can change, triggered each time you make an advance.

Interest rate

- Home equity loan: The home equity loan has a fixed interest rate.

- HELOC: You’ll pay a variable interest rate, which is based on the Prime Lending Rate.

Closing costs

- Home equity loan: You pay the closing costs.

- HELOC: Dupaco pays up to $350 of your closing costs. You’re responsible for any remainder.

Calculate what a HELOC payoff schedule might look like >

When each loan works best

Depending on your needs, one loan will likely work better for you than the other.

- Home equity loan: This might be your best option if you know exactly what you want to use the funds for and know how much money you need. It’s a shorter repayment schedule, which some homeowners appreciate. Home equity loans also are a great option if you like the predictability of knowing exactly how much the payment will be each month. Because the home equity loan payments are always the same, it makes it easier to budget.

- HELOC: Think of the home equity line of credit as a safety net. If you don’t have a specific need—or are unsure if you might have other needs down the road—a line of credit might be right for you. The funds are there, available to use for 10 years, in case life throws the unexpected your way. It’s convenient because you borrow only what you need. While it comes with a variable interest rate, the fluctuations only impact your monthly payment when you make a new advance.

Ultimately, it comes down to personal preference. If you’re unsure which loan is right for you, you can always turn to a Dupaco expert for guidance!

What to keep in mind

Remember, you’re taking out a second mortgage on your property. Anytime you consider doing this, think carefully about why you’re doing so. Because your home is used as collateral, it’s even more important to make your payments on time, every time.

And if you plan to sell you home, you’ll need to have your home equity loan or line of credit paid in full first.

Through careful planning, though, a home equity loan or home equity line of credit can be a powerful way to tap into the equity you’ve built.